Despite fears of a recession, the travel industry is showing no signs of cooling down. Many FTSE airline shares have taken off since hitting their bottoms last year. With IAG (LSE:IAG) and easyJet (LSE:EZJ) being the UK’s most popular airline stocks, I’ll be assessing which one’s a better pick for my portfolio.

The case for IAG

IAG is a group of consolidated airlines. These include the likes of British Airways, Iberia, Aer Lingus, Vueling, and Level. As travel demand continues to remains strong, it’s no surprise to see IAG shares already up 20% this year with the potential to fly even higher.

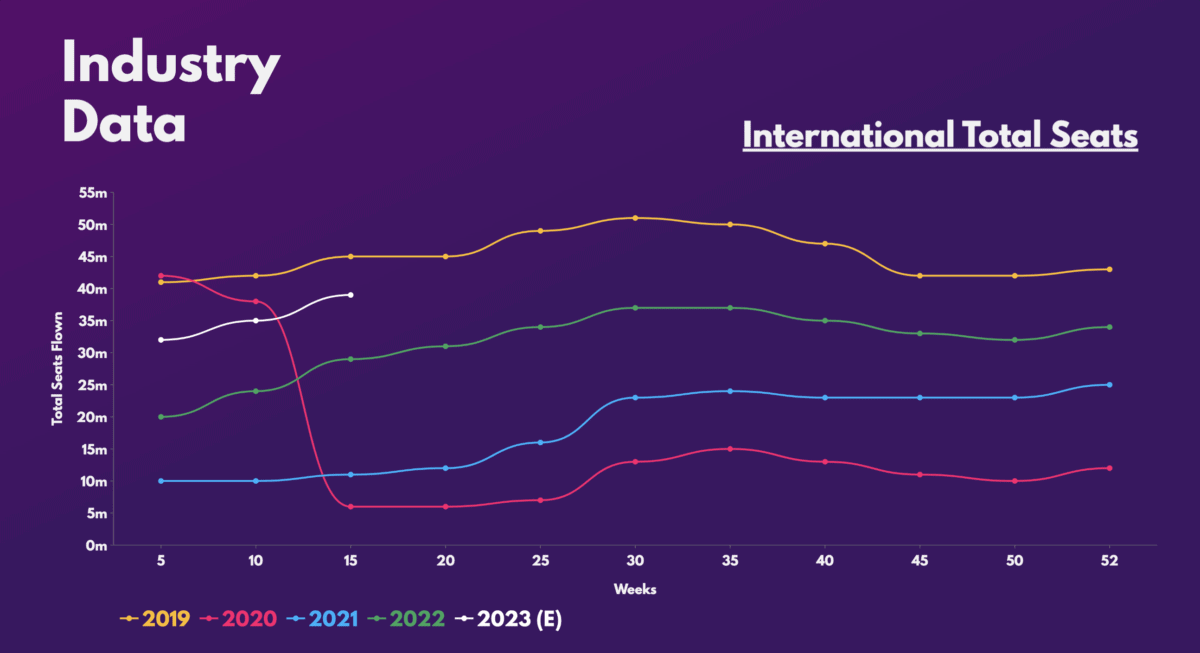

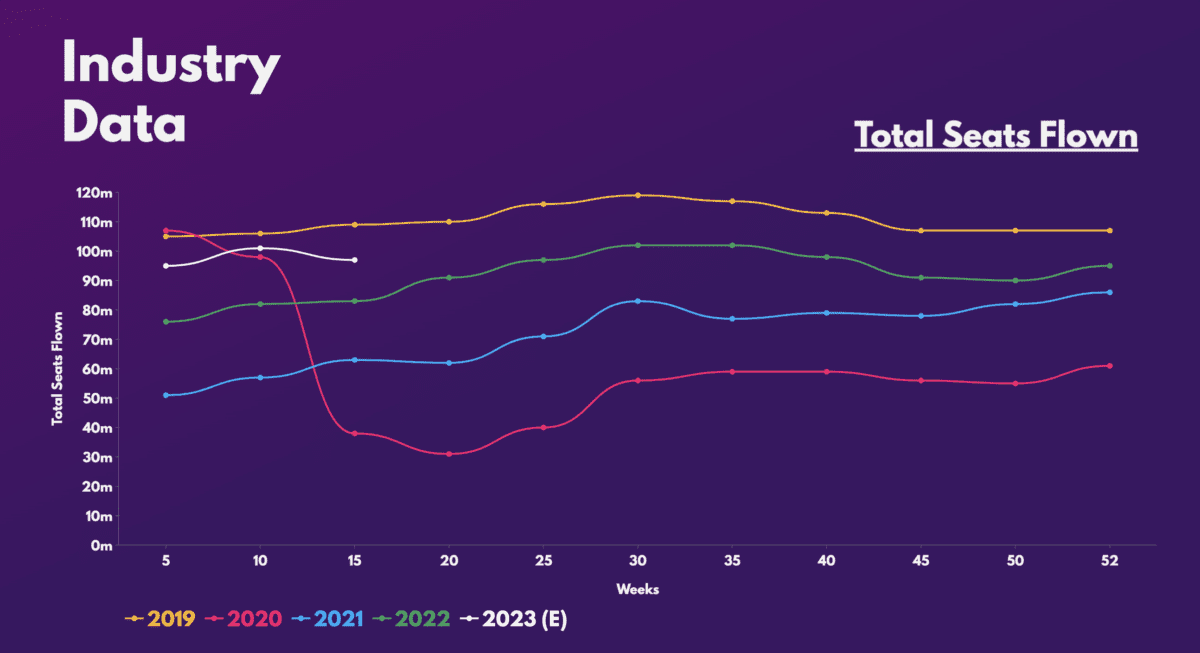

Its capacity and load factors are still lagging pre-pandemic levels, especially with its Asian routes. As such, there’s still potential for the FTSE 100 stalwart to continue growing its revenues as international travel continues to recover. What’s more, long-haul routes are more profitable, which should boost IAG’s bottom line over time.

Should you invest £1,000 in BAE Systems right now?

When investing expert Mark Rogers has a stock tip, it can pay to listen. After all, the flagship Motley Fool Share Advisor newsletter he has run for nearly a decade has provided thousands of paying members with top stock recommendations from the UK and US markets. And right now, Mark thinks there are 6 standout stocks that investors should consider buying. Want to see if BAE Systems made the list?

Additionally, IAG’s premium products like First and Business Class are only at 75% of 2019 levels. This leaves room for margin expansion as these products are more profitable. This would be one of the stock’s unique selling propositions, given its exposure to the premium and long-haul market.

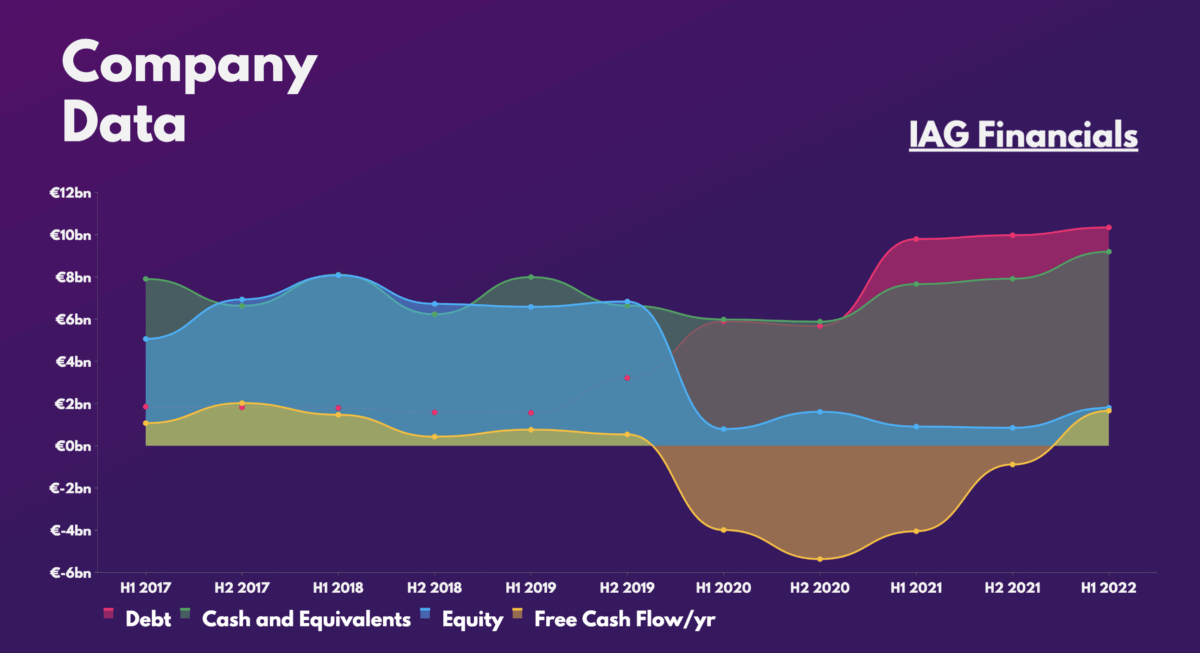

Nonetheless, it’s worth noting that IAG’s financials aren’t ideal. Sitting on a debt-to-equity ratio of 576% (excluding deferred revenue liabilities) will most likely impact future earnings potential and dividends due to debt repayments.

The case for easyJet

The alternative pick is easyJet stock. The Luton-based airline has performed admirably so far this year as well, with its shares up 40%.

Unlike IAG, easyJet has a slightly different business model. Due to the highly competitive nature of the short-haul market, the budget airline operates more on a volume-centric model. The goal is to fit as many seats onto one flight as possible in order to maximise revenue and economies of scale.

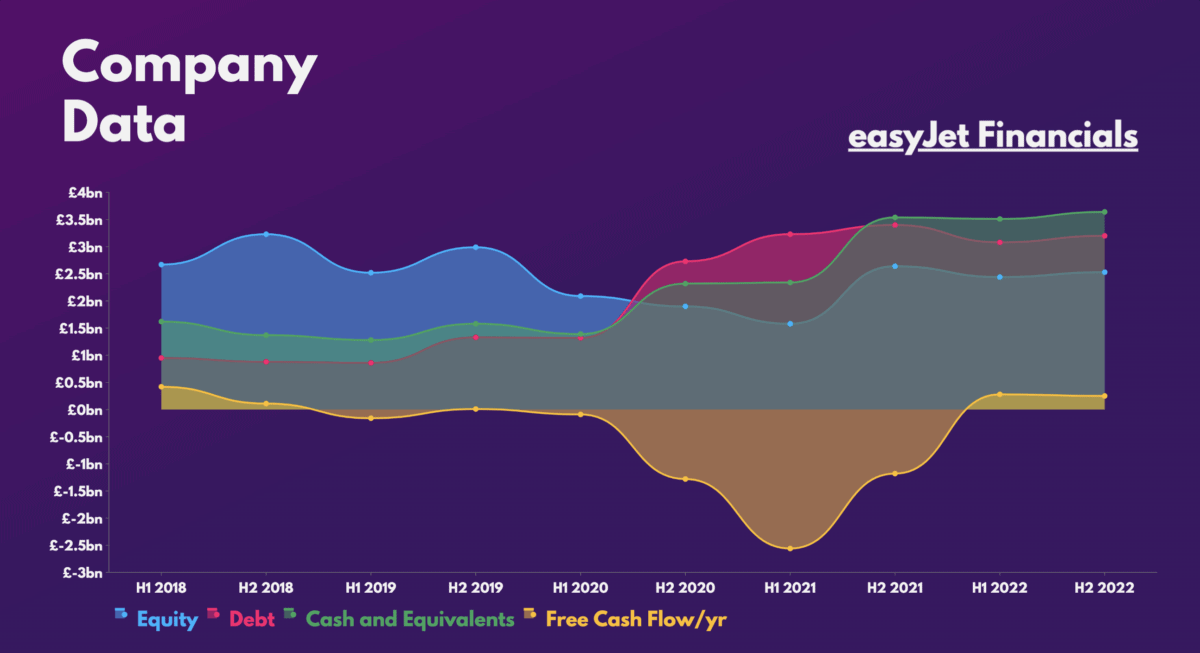

That said, this strategy has its drawbacks as it tends to yield lower margins. Therefore, easyJet and its other low-cost peers are yet to achieve profitability since the pandemic. But where easyJet loses on margins, it makes up for it in its financials. Contrary to its larger competitors, the cost-friendly business has a much sounder balance sheet, giving a much higher margin of safety.

As a result, the FTSE 250 firm is expecting to achieve profitability by September with strong forward bookings. And with total seats flown still behind pre-pandemic levels, there’s still room for easyJet to grow its numbers.

Which is my pick?

Having said that, there’s no doubt that both IAG and easyJet shares are excellent picks to capitalise on the travel rebound. The fact that both stocks are also trading at similar valuation multiples doesn’t make picking a better buy easier either.

| Metrics | IAG | easyJet | Industry average |

|---|---|---|---|

| Price-to-book (P/B) ratio | 5.0 | 1.4 | 1.8 |

| Price-to-sales (P/S) ratio | 0.4 | 0.6 | 0.8 |

| Forward price-to-sales (FP/S) ratio | 0.4 | 0.5 | 0.7 |

| Forward price-to-earnings (FP/E) ratio | 12.9 | 19.9 | 29.1 |

But if I had to pick, I’d go with easyJet stock for two main reasons. The first would be its future dividends as they look more secure due to their stronger balance sheet. The second would be its new Holidays segment, which allows passengers to book travel packages. This is anticipated to be a growth juggernaut for the company and allow it to expand its profit margins into double digits, which I’m a huge fan of. Thus, I’ll soon be buying more easyJet shares for future growth.